Acadian and our Board of Directors are committed to working together to achieve strong and effective corporate governance, with the objective of promoting the long-term interests of our company and the enhancement of value for all shareholders. We continue to review and improve our corporate governance policies and practices in relation to evolving legislation, guidelines, and best practices. Our Board of Directors is of the view that our corporate governance policies and practices and our disclosure in this regard are comprehensive and transparent.

For the name and biographies of our Directors, please click HERE

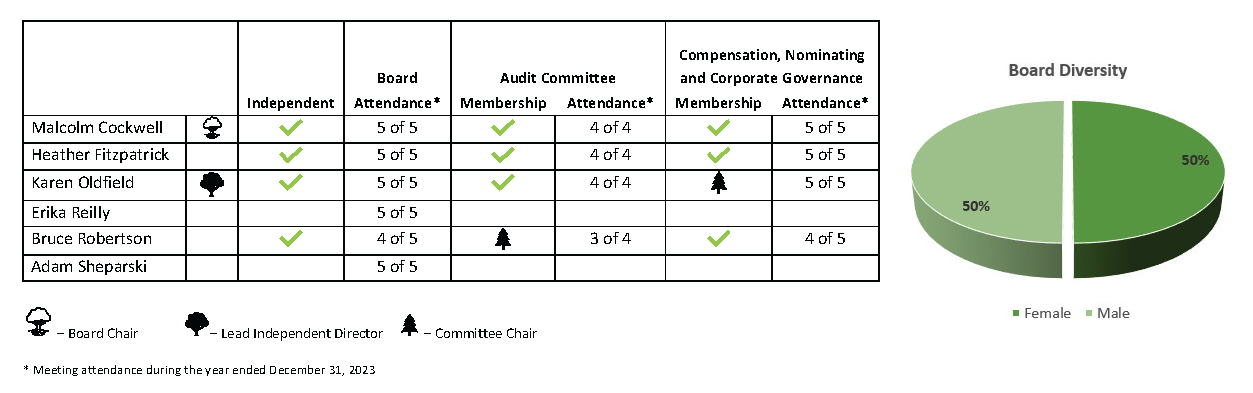

The Board of Directors has two committees: the Compensation, Nominating and Corporate Governance (“CNCG”) Committee and the Audit Committee.

The CNCG Committee consists of independent Directors and is responsible for the composition and compensation of the Board and executive officers. The Committee monitors legislation, regulatory policies and industry best practices dealing with corporate governance. Actively seeking qualified individuals to become Board Directors when required, organizing an orientation and education program for new Directors, reviewing competencies and skills of Board members and ensuring appropriate diversity of the Board are also part of the Committee’s responsibility. (Mandate)

The Audit Committee consists of independent Directors and is responsible for the oversight of the Corporation’s accounting and financial reporting practices including the adequacy of the internal controls throughout the organization. The Committee also ensures management's compliance with all legal and regulatory requirements related to financial reporting and the assessment and monitoring of material risks. (Mandate)

The CNCG Committee consists of independent Directors and is responsible for the composition and compensation of the Board and executive officers. The Committee monitors legislation, regulatory policies and industry best practices dealing with corporate governance. Actively seeking qualified individuals to become Board Directors when required, organizing an orientation and education program for new Directors, reviewing competencies and skills of Board members and ensuring appropriate diversity of the Board are also part of the Committee’s responsibility. (Mandate)

The Audit Committee consists of independent Directors and is responsible for the oversight of the Corporation’s accounting and financial reporting practices including the adequacy of the internal controls throughout the organization. The Committee also ensures management's compliance with all legal and regulatory requirements related to financial reporting and the assessment and monitoring of material risks. (Mandate)

We are committed to full compliance with laws, regulations, and company policies wherever we operate, and we strive to go beyond those legal structures by practicing a higher standard of business and personal ethics. Policies, procedures, and guidelines are important components of our overall compliance and ethics program and have been adopted by the Board to guide Acadian’s activities. Some of the key policies are provided below.

Code of Business Conduct - Acadian expects all personnel to conduct themselves with the highest standards of honesty and integrity and in compliance with all legal requirements, avoiding even the appearance of improper behavior. So that there is no doubt what is expected of Acadian personnel in this regard, the Board of Directors adopted this Code to be followed.

Board Mandate - The Board shall oversee, directly and through its committees, the business and affairs of the Corporation and its subsidiary entities, which are conducted by the officers and employees of the Corporation and its subsidiary entities, to ensure that the best interests of the Corporation and Shareholders are advanced by enhancing shareholder value in a manner that recognizes the concerns of other stakeholders in the Corporation, including its employees, suppliers, customers and the communities in which they operate

Majority Voting Policy - The Board has, in light of best practice standards in Canada, adopted this statement of policy providing for majority voting in director elections at any meeting of Corporation Shareholders where an “uncontested election” of directors is held.

Board Position Descriptions - These position descriptions describe the appointment, role and responsibilities of the Chair of the Board of Directors, the Chair of the CNCG and Audit Committees and Lead Director.

Statement of Corporate Governance Practices - The Corporation and its Board is committed to working together to achieve strong and effective corporate governance, with the objective of promoting the long-term interests of the company and the enhancement of value for all Shareholders.

Acadian expects all Acadian personnel to conduct themselves with the highest standards of honesty and integrity and in compliance with all legal requirements. All employees certify annually that they have read and understand Acadian’s Code of Business Conduct. The Code gives employees strict guidelines that outline proper behavior.

Acadian has processes in place for preventing and detecting violations of law and Acadian’s policies. Acadian also has in place an ethics hotline that is managed by an independent third party and provides a way to anonymously report any suspected unethical, illegal or unsafe behaviour. The Audit Committee has oversight responsibility for the Company’s whistleblower policy and whistleblower hotline.

The Audit Committee of the Board of Directors, executive officers and senior management have responsibility for the oversight of risks facing the Company. The Corporation continually evaluates the potential risks facing the Company, including a range of environmental, social and governance topics. Please see the Risks Related to the Business and Industry in the most recent Annual Information Form.

Management of Acadian, which includes the Chief Executive Officer and Chief Financial Officer, is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in the Canadian Securities Administrators National Instrument 52-109). Internal control over financial reporting is a process designed by, or under the supervision of, the Chief Executive Officer and the Chief Financial Officer and effected by the Board of Directors, management and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with IFRS.

The Board of Directors of Acadian believes that it is in the best interest of Acadian and its Shareholders to align the financial interests of the members of the Board with those of the Company’s shareholders. In this regard, the Compensation, Nominating and Corporate Governance Committee of the Board has recommended, and the Board has adopted, minimum stock ownership guidelines. The Directors of the Company should own shares of the Company’s common stock which have a fair market value equal to three times the annual cash retainer paid to the Director by the Company.